Embark on a journey through the world of travel insurance with pre existing medical conditions. This comprehensive guide delves into the nuances of ensuring your health is protected while exploring the globe.

As we navigate through the intricacies of travel insurance, we unravel the key aspects that every traveler with pre-existing medical conditions should be aware of.

Overview of Travel Insurance with Pre-Existing Medical Conditions

Travel insurance with pre-existing medical conditions refers to a type of insurance coverage that includes any health issues or illnesses that were present before the policy was purchased. These conditions can range from chronic diseases like diabetes or asthma to more serious ailments such as heart disease or cancer.Having travel insurance that covers pre-existing medical conditions is crucial for individuals with ongoing health issues.

It provides peace of mind knowing that any medical emergencies related to their pre-existing conditions will be covered while traveling, preventing potentially high medical costs and ensuring access to necessary healthcare services.

Common Misconceptions or Concerns

- One common misconception is that travel insurance with pre-existing medical conditions is too expensive. While premiums may be slightly higher than standard travel insurance, the benefits of having coverage for existing health issues far outweigh the costs in the event of a medical emergency.

- Another concern is the level of coverage provided for pre-existing conditions. It's essential to carefully review the policy details to understand what is included and excluded in terms of medical treatment, hospitalization, and emergency services related to existing health conditions.

- Some individuals worry about the process of disclosing pre-existing conditions when applying for travel insurance. It's important to provide accurate and complete information to the insurance provider to ensure that all existing health issues are properly covered, avoiding any potential claims denial due to non-disclosure.

Types of Coverage Available

When it comes to travel insurance for individuals with pre-existing medical conditions, there are different types of coverage options to choose from. These options vary in terms of coverage limits, benefits, and premiums. It's important to understand the differences between comprehensive coverage and basic coverage to determine which type best suits your needs.

Comprehensive Coverage

Comprehensive coverage offers extensive protection for travelers with pre-existing medical conditions. It typically includes coverage for medical emergencies, trip cancellations, trip interruptions, baggage loss, and more. While comprehensive coverage may have higher premiums, it provides a wider range of benefits and higher coverage limits.

Basic Coverage

Basic coverage, on the other hand, offers a more limited scope of protection. It usually covers essential benefits such as emergency medical treatment and medical evacuations. Basic coverage may have lower premiums compared to comprehensive coverage, but it may have lower coverage limits and fewer benefits.

Specific Medical Conditions Covered

Travel insurance policies for individuals with pre-existing medical conditions can cover a variety of health issues, including but not limited to:

- Diabetes

- Hypertension

- Asthma

- Heart conditions

- Cancer

These policies are designed to provide coverage and assistance in case of unexpected medical emergencies related to these pre-existing conditions while traveling.

Factors to Consider When Choosing a Policy

When selecting a travel insurance policy with coverage for pre-existing medical conditions, there are several crucial factors to keep in mind to ensure you have adequate protection for your trip.

Role of Age, Destination, Trip Duration, and Medical History

- Age: Consider how your age may impact your health and the likelihood of needing medical attention during your trip. Older individuals may require more comprehensive coverage.

- Destination: The location you are traveling to can affect the cost of medical care. Make sure your policy covers medical expenses in your destination country.

- Trip Duration: Longer trips may pose a higher risk of medical emergencies. Ensure your policy offers coverage for the entire duration of your trip.

- Medical History: Your existing medical conditions play a significant role in determining the coverage you need. Disclose all relevant medical information to the insurer.

Determining Adequate Coverage Amount

It is essential to assess your individual needs and risks to determine the appropriate coverage amount for your travel insurance policy.

- Evaluate the potential costs of medical treatment in your destination country and choose a policy that provides sufficient coverage.

- Consider any activities you plan to engage in during your trip that may increase the risk of injury or illness.

- Factor in the cost of trip cancellation or interruption, baggage loss, and other potential mishaps to ensure comprehensive protection.

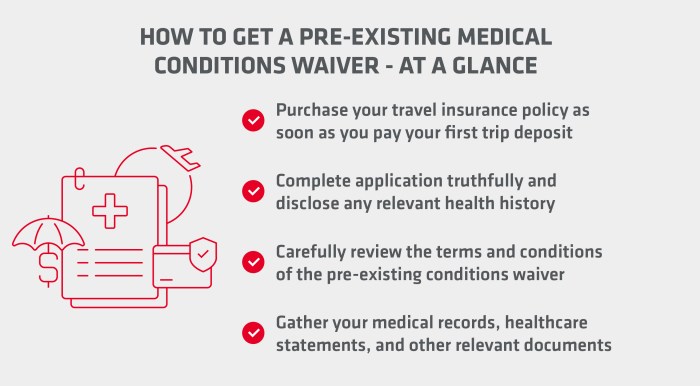

Process of Obtaining Coverage

When it comes to obtaining travel insurance that covers pre-existing medical conditions, there are specific steps to follow to ensure you are adequately protected during your trip.

Disclosure of Medical Conditions

It is crucial to accurately disclose all pre-existing medical conditions during the application process. Failure to do so may result in your claim being denied in the event of a medical emergency. Be honest and provide detailed information about your medical history.

- Fill out the application form carefully and thoroughly.

- Consult with your healthcare provider to ensure you have a comprehensive understanding of your medical conditions.

- Disclose any changes in your health status since the time of application.

Required Documents and Evaluations

In some cases, insurance providers may require additional documentation or medical evaluations to secure coverage for pre-existing medical conditions.

Be prepared to provide medical records, test results, and physician statements to support your application.

- Medical records detailing your pre-existing conditions and treatment history.

- Recent test results or diagnostic reports related to your medical conditions.

- A statement from your healthcare provider outlining your current health status and confirming your ability to travel.

Exclusions and Limitations

When it comes to travel insurance for pre-existing medical conditions, there are certain exclusions and limitations that policyholders need to be aware of. These restrictions can impact the coverage provided by the policy and may affect potential claims. It is crucial to understand these exclusions and limitations to avoid any surprises or gaps in coverage during your travels.

Common Exclusions and Limitations

- Pre-existing medical conditions not declared: One of the most common exclusions in travel insurance policies is the failure to declare pre-existing medical conditions. If you do not disclose your existing health issues when purchasing a policy, any related claims may be denied.

- Specific conditions not covered: Some policies may have a list of pre-existing medical conditions that are not covered under the plan. Make sure to review this list carefully to see if your condition is excluded.

- Limited coverage for existing conditions: Even if your pre-existing medical condition is covered, there may be limitations on the amount of coverage provided. This could affect the reimbursement for medical expenses related to your condition.

Impact on Coverage and Claims

These exclusions and limitations can have a significant impact on your coverage and potential claims. If your pre-existing medical condition is not covered or has limited coverage, you may have to bear the expenses out of pocket. Additionally, failure to disclose your condition can lead to claim denials, leaving you financially vulnerable during your trip.

Strategies for Mitigating Risks

- Declare all pre-existing conditions: To avoid claim denials, make sure to declare all your pre-existing medical conditions when purchasing travel insurance.

- Review policy exclusions carefully: Take the time to review the policy exclusions and limitations to understand what is covered and what is not. This will help you manage your expectations and plan accordingly.

- Consider supplemental coverage: If your pre-existing condition is excluded or has limited coverage, consider purchasing supplemental insurance specifically for that condition to fill the gaps in your primary policy.

Final Conclusion

In conclusion, understanding the importance of travel insurance with pre existing medical conditions is crucial for a worry-free trip. By being informed and prepared, you can enjoy your travels with peace of mind knowing you are covered.

FAQ Corner

What are pre-existing medical conditions?

Pre-existing medical conditions refer to any health issues that you have been diagnosed with before purchasing travel insurance.

What factors should be considered when choosing a policy?

When selecting a travel insurance policy with pre-existing conditions coverage, factors such as age, destination, trip duration, and medical history should be taken into account.

How can one ensure accurate disclosure of medical conditions during the application process?

To disclose medical conditions accurately, it is essential to provide complete and truthful information in the application form.

What are common exclusions in travel insurance policies for pre-existing medical conditions?

Common exclusions may include certain medical conditions, high-risk activities, or non-disclosure of relevant information.

How can risks associated with policy exclusions be mitigated?

Risks associated with policy exclusions can be mitigated by carefully reading the policy documents, understanding the terms and conditions, and seeking clarification from the insurance provider if needed.

![Best Seniors Travel Insurance Over 65 Quotes [Compare Rates]](https://management.vpn.co.id/wp-content/uploads/2025/10/International-Travel-Insurance-For-Seniors-120x86.png)