Exploring the realm of travel insurance health conditions, this guide aims to shed light on the importance of coverage for pre-existing health conditions, the types of conditions typically covered, exclusions and limitations to be aware of, and the benefits of opting for comprehensive insurance.

Dive in to discover all you need to know before your next trip!

Importance of Travel Insurance for Health Conditions

Travel insurance for health conditions is essential for individuals with pre-existing medical issues. Without adequate coverage, there are significant risks associated with traveling, especially when unexpected health emergencies arise. Travel insurance provides peace of mind by offering financial protection and access to necessary medical care while abroad.

Risks of Traveling Without Health Condition Coverage

Traveling without health condition coverage can lead to exorbitant medical expenses in case of emergencies. Without insurance, individuals may not receive proper treatment or evacuation, leading to compromised health outcomes. In extreme cases, lack of coverage can result in financial burden or even prevent individuals from getting the necessary care they require.

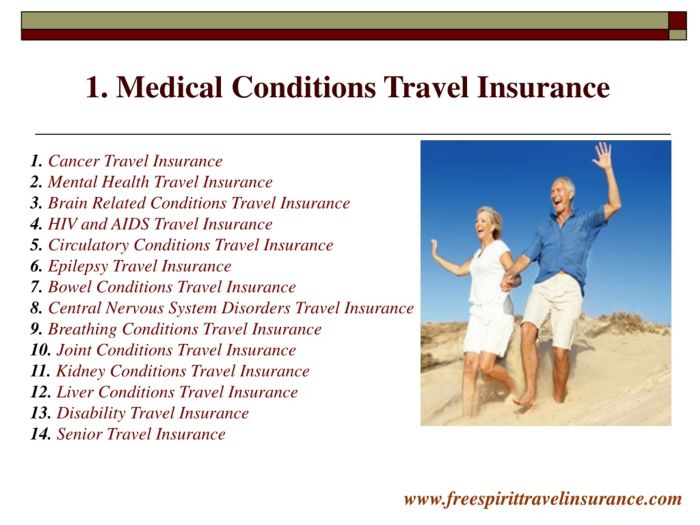

Types of Health Conditions Covered by Travel Insurance

Travel insurance typically covers a range of health conditions to ensure travelers are protected in case of unexpected medical emergencies while abroad.

Common Health Conditions Covered

- Respiratory conditions such as asthma

- Cardiovascular conditions like high blood pressure

- Allergies requiring emergency treatment

- Diabetes management and related complications

- Digestive issues such as gastritis or ulcers

Declaring Pre-existing Health Conditions

When purchasing travel insurance, it is crucial to declare any pre-existing health conditions to ensure proper coverage. Failure to disclose such conditions could result in denied claims or limited coverage.

Varying Coverage Based on Health Condition Severity

Coverage under travel insurance may vary depending on the type and severity of the health condition. While minor conditions may be covered without additional premiums, more severe conditions or those requiring ongoing treatment may require special consideration and possibly higher premiums.

Exclusions and Limitations of Travel Insurance for Health Conditions

Travel insurance for health conditions may have certain exclusions and limitations that travelers need to be aware of before purchasing a policy. These restrictions can affect coverage and premiums, so it is important to understand them thoroughly.

Specific Health Conditions Excluded from Standard Travel Insurance Policies

Some common health conditions that are usually excluded from standard travel insurance policies include:

- Certain pre-existing medical conditions

- Chronic illnesses that require ongoing treatment

- Mental health conditions

- Injuries sustained while participating in high-risk activities

Limitations on Coverage and Age Restrictions

Travel insurance policies may have limitations on coverage based on age, with some policies not providing coverage for individuals over a certain age. Additionally, certain treatments or medical procedures may be excluded from coverage, especially if they are considered elective or not essential for the traveler's health

Impact of Pre-existing Conditions on Coverage and Premiums

Pre-existing medical conditions can significantly affect coverage and premiums for travel insurance. In some cases, pre-existing conditions may not be covered at all, while in others, coverage may be available but at a higher premium. It is crucial for travelers to disclose any pre-existing conditions accurately when purchasing travel insurance to ensure they have the appropriate coverage in place.

Benefits of Comprehensive Travel Insurance

Traveling with comprehensive travel insurance that includes coverage for health conditions offers several advantages. In comparison to basic travel insurance plans, comprehensive ones provide a wider range of coverage and benefits, especially for individuals with pre-existing health conditions. Here are some key benefits of opting for comprehensive travel insurance:

Extended Coverage for Pre-Existing Health Conditions

Comprehensive travel insurance often includes coverage for pre-existing health conditions, which may not be covered by basic plans. This ensures that individuals with chronic illnesses or medical conditions can travel with peace of mind, knowing that they are protected in case of any health-related emergencies.

- Comprehensive travel insurance typically covers medical expenses related to pre-existing conditions, including doctor visits, hospitalization, and medication.

- It may also provide coverage for emergency medical evacuation or repatriation in case the individual needs to return home for medical treatment.

- Having coverage for pre-existing health conditions can help avoid unexpected out-of-pocket expenses and financial burden while traveling.

Additional Benefits and Services

In addition to health condition coverage, comprehensive travel insurance often includes a range of additional benefits and services that can be beneficial for travelers with medical needs.

- Some comprehensive plans offer coverage for trip cancellations or interruptions due to health reasons, providing reimbursement for non-refundable expenses.

- Travel assistance services, such as access to a 24/7 helpline for medical advice or assistance in locating medical facilities abroad, are commonly included in comprehensive plans.

- Coverage for lost or delayed baggage, emergency dental treatment, and accidental death or dismemberment may also be part of comprehensive travel insurance packages.

Peace of Mind and Security

By choosing comprehensive travel insurance that includes coverage for health conditions, travelers can enjoy peace of mind and security throughout their trip. Knowing that they are protected in case of unexpected medical emergencies or health issues can make the travel experience more enjoyable and worry-free.Overall, opting for comprehensive travel insurance with coverage for health conditions is highly recommended for individuals with pre-existing medical conditions or those seeking additional peace of mind while traveling.

Final Summary

In conclusion, understanding the nuances of travel insurance when it comes to health conditions is essential for savvy travelers. Whether you're dealing with pre-existing conditions or simply want to be prepared for any health-related emergencies on your journey, being well-informed about your insurance options can provide peace of mind.

Stay safe and covered on your adventures!

Popular Questions

What types of health conditions are usually covered by travel insurance?

Travel insurance typically covers common conditions like asthma, diabetes, high blood pressure, and others. It's important to declare these conditions when purchasing insurance.

Are there specific health conditions that are often excluded from standard travel insurance policies?

Some insurers exclude conditions like cancer, terminal illnesses, or mental health disorders from their standard policies. It's crucial to check the policy details.

How does declaring pre-existing health conditions affect coverage and premiums?

Declaring pre-existing conditions can impact the coverage you receive and the premiums you pay. It's vital to be transparent about your health history when buying travel insurance.

![Best Seniors Travel Insurance Over 65 Quotes [Compare Rates]](https://management.vpn.co.id/wp-content/uploads/2025/10/International-Travel-Insurance-For-Seniors-120x86.png)