Embark on a journey through the intricacies of pre-existing medical travel insurance, where protection meets peace of mind. Explore the nuances of coverage, exclusions, and the importance of tailored policies in this ever-evolving landscape.

Delve into the realm of pre-existing medical conditions and how insurance can be a game-changer in unforeseen situations.

What is Pre-Existing Medical Travel Insurance?

Pre-existing medical travel insurance is a type of travel insurance that specifically covers individuals with existing medical conditions. These conditions are declared before purchasing the insurance policy.

Definition of Pre-Existing Medical Conditions

Pre-existing medical conditions are health issues that the insured individual has been diagnosed with or received treatment for before purchasing the travel insurance policy. These conditions can range from chronic illnesses to recent surgeries.

Differences from Regular Travel Insurance

Unlike regular travel insurance, pre-existing medical travel insurance provides coverage for existing health conditions that may require medical attention while traveling. Regular travel insurance typically excludes coverage for pre-existing conditions.

Examples of Common Pre-Existing Medical Conditions Covered

- Diabetes

- High blood pressure

- Asthma

- Heart conditions

- Arthritis

Importance of Pre-Existing Medical Travel Insurance

Traveling with pre-existing medical conditions can be risky, which is why having pre-existing medical travel insurance is crucial. This specialized insurance provides coverage for any unexpected medical emergencies related to existing health conditions while traveling abroad. It offers peace of mind and financial protection in case of unforeseen health issues.

Benefits of Pre-Existing Medical Travel Insurance

- Comprehensive Coverage: Unlike standard travel insurance, pre-existing medical travel insurance covers expenses related to existing health conditions, including doctor visits, hospital stays, and medications.

- Emergency Medical Evacuation: In critical situations, this insurance can arrange and cover the cost of emergency medical evacuation to the nearest adequate medical facility.

- Coverage for Trip Cancellation or Interruption: Pre-existing medical travel insurance may provide coverage for trip cancellation or interruption due to health-related issues, ensuring you don't lose your investment.

- Peace of Mind: Knowing that you have adequate coverage for your pre-existing medical conditions allows you to enjoy your trip without worrying about potential health emergencies.

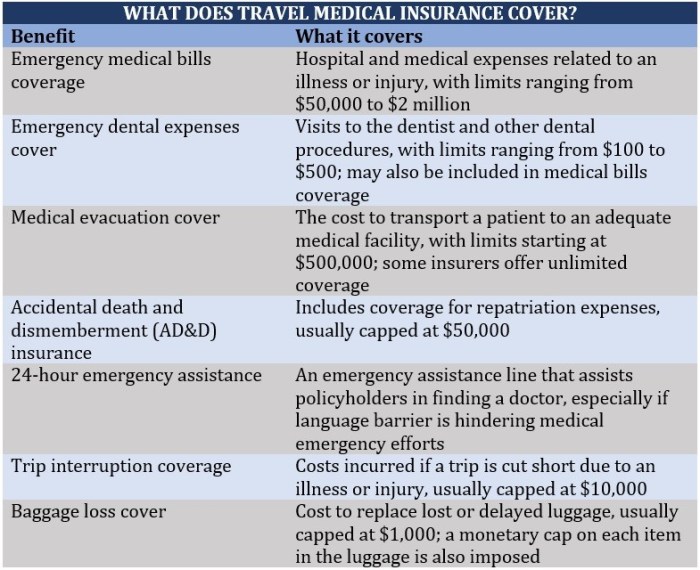

Coverage and Exclusions

Travel insurance for pre-existing medical conditions typically provides coverage for medical emergencies during your trip. This type of insurance is designed to offer protection in case your pre-existing condition flares up or you require medical treatment while traveling.

Coverage Offered

- Coverage for medical expenses related to pre-existing conditions

- Emergency medical treatment and hospitalization

- Emergency medical evacuation to the nearest adequate medical facility

- Repatriation of remains in case of death

- 24/7 emergency assistance services

Exclusions to be Aware of

- Pre-existing conditions not declared or not covered by the policy

- Medical treatment for conditions not related to pre-existing conditions

- Non-emergency medical services or elective procedures

- Travel to countries with travel advisories or high-risk destinations

- Participation in hazardous activities or extreme sports

Scenarios for Coverage

- If you have a pre-existing heart condition and experience a heart attack while traveling, your medical expenses would be covered.

- In the event of a sudden illness related to your pre-existing condition, emergency medical treatment would be covered.

How to Obtain Pre-Existing Medical Travel Insurance

When it comes to obtaining pre-existing medical travel insurance, there are specific steps involved to ensure you get the coverage you need for your trip.

Documentation and Application Process

- Start by gathering all relevant medical documentation related to your pre-existing condition. This may include medical records, prescriptions, and doctor's notes.

- Fill out the insurance application form accurately and honestly, disclosing all pre-existing conditions to the insurance provider.

- Some insurance providers may require a medical examination or questionnaire to assess your current health status before providing coverage.

- Submit all required documentation and information to the insurance provider for review and processing.

Factors Affecting Eligibility and Premium Rates

- Age: Older travelers may face higher premiums due to increased health risks.

- Severity of Pre-Existing Condition: The more severe your condition, the higher the premium may be.

- Travel Destination: Some regions may have higher healthcare costs, affecting premium rates.

- Length of Trip: Longer trips may result in higher premiums.

Comparison of Insurance Providers

- Research and compare different insurance providers offering pre-existing medical travel insurance to find the best coverage for your needs.

- Consider factors such as coverage limits, premium rates, customer reviews, and claim processing efficiency when choosing an insurance provider.

- Get quotes from multiple providers to compare costs and coverage options before making a decision.

Tips for Choosing the Right Policy

When selecting pre-existing medical travel insurance, it is crucial to consider various factors to ensure you choose the right policy that meets your needs and provides adequate coverage. Reading the policy terms and conditions thoroughly is essential to avoid any surprises or misunderstandings.

Additionally, customization options are available to tailor the coverage to your specific medical conditions and travel requirements.

Checklist of Factors to Consider

- Extent of Coverage: Ensure the policy covers all pre-existing medical conditions you have.

- Medical Evacuation and Repatriation: Check if the policy includes coverage for emergency medical evacuation and repatriation.

- Coverage Limits: Understand the maximum limits for medical expenses, hospital stays, and other benefits.

- Travel Destination: Confirm that the policy covers the specific countries you plan to visit.

- Exclusions: Be aware of any exclusions or limitations in the policy that may affect your coverage.

Importance of Reading Policy Terms and Conditions

It is vital to carefully review the policy terms and conditions to fully understand what is covered, any limitations or exclusions, claim procedures, and other important details. By being well-informed about the policy, you can make informed decisions and avoid any potential issues during your travels.

Customization Options for Tailored Coverage

Insurance providers offer customization options to tailor the coverage to your specific needs. You can add extra coverage for certain medical conditions, increase coverage limits, or include additional benefits like trip cancellation or lost baggage protection. By customizing your policy, you can ensure you have comprehensive coverage that meets your unique requirements.

End of Discussion

In conclusion, pre-existing medical travel insurance serves as a lifeline for those with unique health needs on the go. With the right policy in hand, travelers can navigate the world with confidence and security.

Expert Answers

What does pre-existing medical travel insurance cover?

Pre-existing medical travel insurance typically covers emergency medical expenses related to existing health conditions during travel.

Are all pre-existing conditions covered under this type of insurance?

No, not all pre-existing conditions are covered. It's essential to check the policy details for specific inclusions and exclusions.

Can I purchase pre-existing medical travel insurance if I have a chronic illness?

Yes, you can usually obtain this insurance, but coverage and premiums may vary based on the severity of the condition.

Is pre-existing medical travel insurance more expensive than regular travel insurance?

Yes, it can be pricier due to the added risk factors associated with existing health conditions.

Can I customize my pre-existing medical travel insurance policy?

Some insurance providers offer customization options to tailor the coverage to individual needs, providing flexibility.

![Best Seniors Travel Insurance Over 65 Quotes [Compare Rates]](https://management.vpn.co.id/wp-content/uploads/2025/10/International-Travel-Insurance-For-Seniors-120x86.png)