Embark on a journey of understanding as we delve into the world of travel insurance plans. From single-trip to annual multi-trip options, domestic to international coverage, and specialized plans for medical emergencies or trip cancellations, this guide has it all.

Get ready to compare, contrast, and choose the best travel insurance for your next adventure.

In this guide, we will explore the key aspects of travel insurance plans, from coverage details to cost analysis, ensuring you make an informed decision for your travels.

Introduction to Travel Insurance Plans

Travel insurance plans are essential tools for travelers to mitigate risks and ensure peace of mind during their trips. These plans provide coverage for a variety of unforeseen circumstances that may occur before or during travel, offering financial protection and assistance when needed.Common features of travel insurance plans include coverage for trip cancellations, medical emergencies, lost or delayed baggage, and evacuation services.

Additionally, some plans may include coverage for trip interruptions, travel delays, and even rental car damage.Examples of scenarios where travel insurance plans are essential include sudden illness or injury while traveling, flight cancellations due to unforeseen circumstances, lost luggage, or natural disasters affecting travel plans.

Having a travel insurance plan in place can help travelers navigate these unexpected situations with ease and without incurring significant financial losses.

Types of Travel Insurance Plans

When selecting a travel insurance plan, it is essential to consider the type that best suits your needs. There are various options available, each catering to different travel scenarios and requirements. Let's explore the differences between single-trip insurance and annual multi-trip insurance, domestic travel insurance, and international travel insurance, as well as the benefits of specialized plans like medical, baggage, or trip cancellation insurance.

Single-Trip Insurance vs. Annual Multi-Trip Insurance

Single-trip insurance provides coverage for a specific journey and typically lasts from the departure date to the return date. This type of insurance is ideal for individuals who travel infrequently or have planned a one-time trip. On the other hand, annual multi-trip insurance offers coverage for multiple trips within a year, making it a cost-effective option for frequent travelers.

It eliminates the need to purchase separate insurance for each trip, saving time and money in the long run.

Differences between Domestic Travel Insurance and International Travel Insurance

Domestic travel insurance is designed to cover trips within your home country, providing protection against unforeseen events such as trip cancellations, delays, or medical emergencies. International travel insurance, on the other hand, offers coverage for trips outside your home country, including medical expenses, emergency evacuation, and repatriation.

It is essential for international travelers to have this type of insurance due to differences in healthcare systems and potential risks abroad.

Benefits of Specialized Travel Insurance Plans

Specialized travel insurance plans cater to specific needs that may not be covered by standard policies. Medical insurance provides coverage for medical expenses incurred during a trip, ensuring you receive proper care without financial burden. Baggage insurance protects your belongings in case of loss, theft, or damage, offering peace of mind while traveling.

Trip cancellation insurance reimburses non-refundable expenses if your trip is canceled or interrupted due to unforeseen circumstances, such as illness or natural disasters.

Coverage Comparison

When comparing travel insurance plans, it's important to understand the coverage provided by basic plans and the additional benefits offered by comprehensive plans. It's also crucial to be aware of any exclusions or limitations that may apply to your coverage.

Basic Travel Insurance Coverage

Basic travel insurance plans typically include coverage for:

- Trip cancellation or interruption

- Emergency medical expenses

- Lost or delayed baggage

- Travel delays

Additional Coverage in Comprehensive Plans

Comprehensive travel insurance plans may offer additional benefits such as:

- Emergency medical evacuation

- Coverage for adventure activities

- Rental car insurance

- Accidental death and dismemberment

Exclusions and Limitations

It's important to be aware of the exclusions or limitations that may apply to your travel insurance coverage, such as:

- Pre-existing medical conditions

- High-risk activities

- Unattended baggage

- Travel to certain countries or regions

Cost and Value Analysis

When it comes to travel insurance plans, understanding the cost and value is crucial in making the right decision. Let's dive into the factors influencing the cost, comparing premium plans with coverage, and finding affordable options without compromising on protection

Factors Affecting the Cost of Travel Insurance Plans

- Destination: The cost of travel insurance can vary based on the location you are traveling to. Countries with higher healthcare costs or risk levels may result in higher premiums.

- Duration of Trip: Longer trips typically have higher premiums as there is a higher chance of something going wrong during an extended period away from home.

- Age of Traveler: Older travelers may face higher premiums due to increased health risks and potential medical expenses.

- Type of Coverage: The extent of coverage, such as medical expenses, trip cancellation, or baggage loss, can impact the cost of the insurance plan.

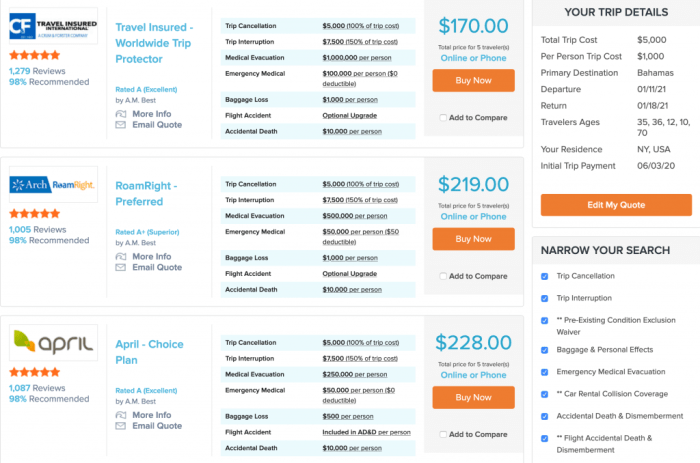

Comparing Value of Premium Plans

- Premium vs. Coverage: Evaluate the coverage offered by premium plans and compare it with the cost. Sometimes, a slightly higher premium can provide extensive coverage benefits.

- Add-Ons: Consider any additional benefits or add-ons included in premium plans, such as coverage for adventure activities, rental car protection, or emergency evacuation.

- Policy Limits: Look at the maximum limits for each coverage type to determine if the premium plan offers sufficient protection for your travel needs.

Tips for Finding Affordable Travel Insurance Plans

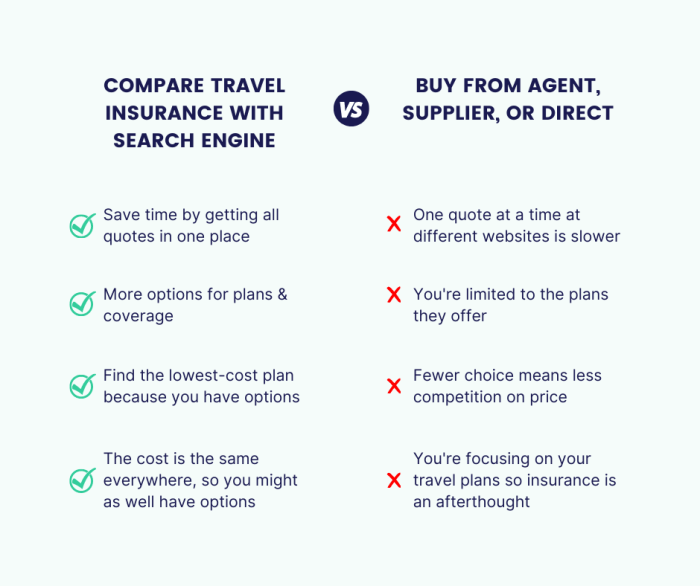

- Compare Quotes: Obtain quotes from multiple insurance providers to find the best value for your budget and travel requirements.

- Opt for Essential Coverage: Focus on essential coverage areas like medical expenses and trip cancellation to prioritize protection while keeping costs down.

- Consider Deductibles: Choosing a plan with a higher deductible can lower the premium cost, but ensure you can afford the deductible in case of a claim.

- Review Exclusions: Understand the exclusions of each plan to avoid surprises later on and ensure the coverage aligns with your travel activities.

Claim Process and Customer Support

When it comes to travel insurance, understanding the claim process and having reliable customer support can make a huge difference in your overall experience. Let's delve into the steps involved in filing a claim, compare the claim settlement process of different insurance providers, and discuss the importance of good customer support in the travel insurance industry.

Filing a Claim

- Notify the insurance company: Contact your insurance provider as soon as possible after the incident occurs.

- Submit documentation: Provide all necessary documents such as police reports, medical records, and receipts to support your claim.

- Wait for assessment: The insurance company will assess your claim based on the provided documents and information.

- Receive settlement: If your claim is approved, you will receive the agreed-upon settlement amount.

Comparison of Claim Settlement Process

| Insurance Provider | Claim Settlement Process |

|---|---|

| Company A | Offers quick claim processing with minimal documentation requirements. |

| Company B | Has a detailed claim investigation process, which may result in longer processing times. |

| Company C | Provides 24/7 claim support for emergencies, ensuring a prompt response to claims. |

Importance of Customer Support

- Assistance in emergencies: Good customer support can provide immediate assistance during emergencies while traveling.

- Guidance through the claim process: Knowledgeable customer support representatives can guide you through the claim process, making it easier for you to file a claim.

- Peace of mind: Knowing that you have access to reliable customer support can give you peace of mind while traveling, especially in unfamiliar places.

Closing Notes

As we wrap up our discussion on comparing travel insurance plans, remember that the right coverage can make all the difference in your travel experience. Whether it's understanding the claim process or the value of premium plans, being prepared with the right insurance can give you peace of mind on your journeys.

Safe travels!

FAQ Summary

Are there any specific conditions where travel insurance plans are essential?

Yes, travel insurance is crucial when traveling to countries with high medical costs, engaging in adventure sports, or facing unexpected trip cancellations.

What factors can affect the cost of travel insurance plans?

The cost of travel insurance can be influenced by factors such as age, destination, trip duration, coverage limits, and any pre-existing medical conditions.

How do I file a claim with a travel insurance company?

When filing a claim, you typically need to provide documentation like receipts, medical reports, and a claim form. Contact your insurance provider for specific instructions.

![Best Seniors Travel Insurance Over 65 Quotes [Compare Rates]](https://management.vpn.co.id/wp-content/uploads/2025/10/International-Travel-Insurance-For-Seniors-120x86.png)