Foreign travel health insurance is a crucial aspect for international travelers, providing peace of mind and protection in unforeseen circumstances. From unexpected medical emergencies to sudden illnesses, having the right insurance can make all the difference while abroad. Let's delve into the world of foreign travel health insurance and explore why it's a must-have for anyone venturing beyond their home country.

Importance of Foreign Travel Health Insurance

Traveling abroad can be an exciting and enriching experience, but it also comes with certain risks, especially when it comes to health emergencies. Having foreign travel health insurance is crucial for international travelers to ensure they are adequately covered in case of unexpected medical situations.

Protection in Medical Emergencies

When traveling to a foreign country, you may encounter unfamiliar healthcare systems, language barriers, and different medical practices. In the event of an accident or sudden illness, having foreign travel health insurance can provide coverage for medical expenses, including hospitalization, doctor's fees, and emergency medical evacuation.

Without insurance, these costs can be exorbitant and may lead to financial strain or even compromise the quality of care received.

Peace of Mind

Foreign travel health insurance offers peace of mind knowing that you are protected in case of a medical emergency. Whether it's a minor injury or a serious illness, having insurance ensures that you can access medical treatment without worrying about the financial implications.

This allows you to focus on enjoying your trip without the added stress of potential healthcare costs.

Financial Security

Traveling without adequate health insurance coverage can be risky, as medical expenses abroad can be significantly higher than in your home country. In the absence of insurance, you may have to pay out of pocket for medical services, medications, or hospital stays, which can lead to substantial financial burden.

Foreign travel health insurance safeguards you against these unforeseen expenses and provides financial security during your trip.

Access to Quality Care

In some countries, the standard of healthcare may not be up to par with what you are accustomed to at home. With specialized foreign travel health insurance, you can ensure access to quality medical care and facilities, even in remote or underdeveloped areas.

This can be a lifesaver in critical situations where timely and appropriate medical attention is crucial for your well-being.

Coverage Options

When it comes to foreign travel health insurance, there are various coverage options available in the market to suit different needs and budgets. Understanding the differences between basic and comprehensive plans, as well as knowing about add-ons and limitations, can help travelers make informed decisions.

Basic Foreign Travel Health Insurance vs. Comprehensive Plans

Basic foreign travel health insurance typically covers essential medical expenses such as hospitalization, emergency medical evacuation, and repatriation of remains. It may also include coverage for emergency dental treatment and accidental death and dismemberment. However, comprehensive plans offer a wider range of coverage, including trip cancellation/interruption, baggage loss, and emergency travel assistance services.

Add-Ons and Riders

Travelers can enhance their foreign travel health insurance coverage by adding on specific riders or benefits to their existing policy. Some common add-ons include coverage for adventure sports, pre-existing medical conditions, and trip delay/cancellation due to natural disasters or terrorism.

These add-ons can provide extra peace of mind during international travel.

Exclusions and Limitations

It is important for travelers to be aware of the exclusions and limitations in their foreign travel health insurance policies. Common exclusions may include pre-existing conditions, high-risk activities, and non-medical emergencies. Additionally, some policies may have limitations on coverage amounts or specific medical treatments.

It is crucial to carefully read and understand the terms and conditions of the policy to avoid any surprises during a medical emergency abroad.

Factors to Consider When Choosing a Policy

When selecting a foreign travel health insurance policy, there are several key factors that travelers should take into consideration to ensure they have the appropriate coverage for their trip.

Destination Country

The healthcare system and costs vary from one country to another. It is essential to choose a policy that provides coverage in the destination country and includes medical facilities that meet your standards.

Length of Stay

The duration of your trip can impact the type of coverage you need. Longer stays may require more comprehensive insurance to cover any unforeseen medical emergencies that may arise during your time abroad.

Age of the Traveler

Age plays a significant role in determining the cost and coverage of a travel health insurance policy. Older travelers may require additional coverage for pre-existing conditions or higher medical limits.

Pre-existing Conditions

If you have any pre-existing medical conditions, it is crucial to disclose them when purchasing a policy

Reputation and Reliability of Insurance Providers

Research and evaluate the reputation and reliability of insurance providers offering foreign travel health insurance. Look for reviews, ratings, and feedback from other travelers to ensure you are choosing a reputable provider.

Adequate Coverage Amount

Determine the appropriate coverage amount based on the destination's healthcare costs. Consider factors such as hospitalization expenses, emergency medical evacuation, and repatriation coverage to ensure you have adequate protection during your travels.

Claim Process and Assistance Services

When it comes to foreign travel health insurance, understanding the claim process and the assistance services available is crucial for travelers in case of medical emergencies abroad.

Typical Claim Process

- After receiving medical treatment abroad, travelers need to keep all receipts and medical documents.

- They must inform their insurance provider as soon as possible and fill out a claim form.

- The insurer will assess the claim based on the policy coverage and documentation provided.

- Once approved, the reimbursement will be processed according to the policy terms.

Role of Assistance Services

- Emergency medical evacuation ensures travelers are transported to the nearest adequate medical facility if needed.

- Repatriation covers the cost of returning the traveler to their home country for further treatment.

- 24/7 helplines provide assistance and guidance in case of emergencies, helping travelers navigate the healthcare system in a foreign country.

Tips for Medical Emergencies

- Contact the insurance provider immediately in case of a medical emergency.

- Keep copies of all medical records, receipts, and communication with healthcare providers.

- Follow the insurer's instructions and provide all necessary documentation for the claim process.

Coordination with Healthcare Providers

- Insurance providers have networks of healthcare providers in foreign countries for direct billing.

- In cases where direct billing is not available, travelers may need to pay upfront and seek reimbursement later.

- Insurers handle coordination with healthcare providers to ensure smooth treatment and payment processes.

Wrap-Up

In conclusion, foreign travel health insurance serves as a safety net for travelers, offering financial and medical support when needed most. By understanding the importance of being adequately covered while abroad, individuals can enjoy their journeys with added security and confidence.

FAQ Guide

What does foreign travel health insurance typically cover?

Foreign travel health insurance usually covers medical expenses, emergency evacuation, repatriation, and sometimes trip cancellations due to health issues.

Are pre-existing conditions covered under foreign travel health insurance?

Pre-existing conditions may not be covered by standard policies, but some insurers offer options to include coverage for them at an additional cost.

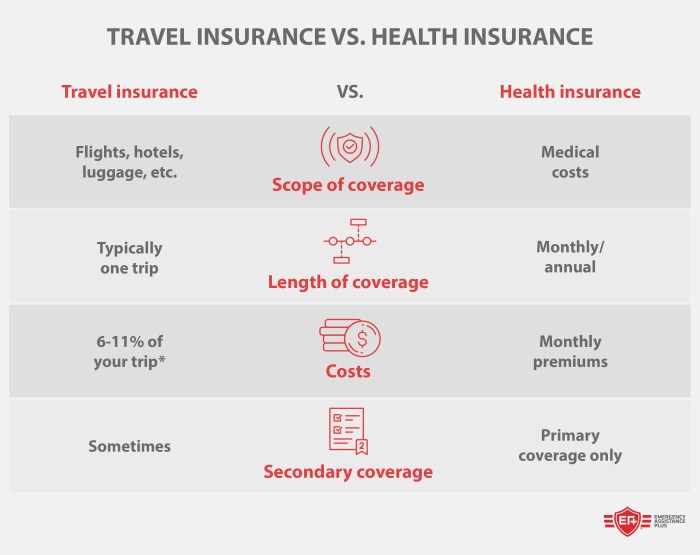

Do I need foreign travel health insurance if I already have domestic health insurance?

While some domestic health insurance plans offer limited coverage abroad, they may not provide comprehensive protection. It's advisable to have foreign travel health insurance for full coverage while traveling internationally.

![Best Seniors Travel Insurance Over 65 Quotes [Compare Rates]](https://management.vpn.co.id/wp-content/uploads/2025/10/International-Travel-Insurance-For-Seniors-120x86.png)