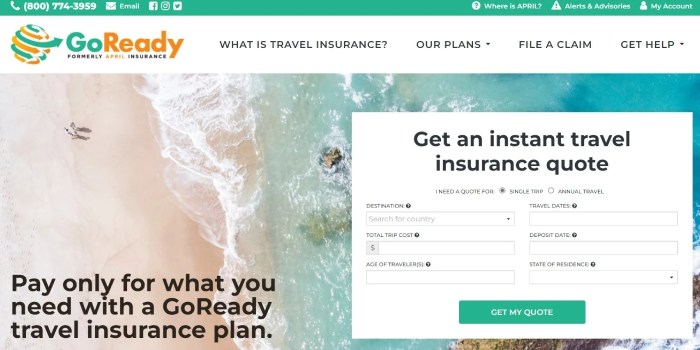

Diving into the realm of go ready travel insurance, this introduction aims to shed light on the importance of having reliable travel insurance coverage. From unexpected emergencies to seamless claims, the world of travel insurance offers a safety net that every traveler should consider before embarking on their next adventure.

As we delve deeper into the intricacies of go ready travel insurance, we uncover the key elements that make it a vital component of any travel plan.

Importance of Travel Insurance

![GoReady Travel Insurance Review --- Is it Worth It? [2025] GoReady Travel Insurance Review --- Is it Worth It? [2025]](https://management.vpn.co.id/wp-content/uploads/2025/10/67611595ff9158fd4a8d5e6b_1600-x-1100.jpg)

Travel insurance is a crucial component of trip planning that provides peace of mind and financial protection in unforeseen circumstances. Whether it's a medical emergency, trip cancellation, or lost luggage, having travel insurance can save you from significant financial burdens.

Types of Coverage Options

- Medical Coverage: Covers medical expenses, emergency medical evacuation, and repatriation in case of illness or injury during the trip.

- Trip Cancellation/Interruption: Reimburses non-refundable trip costs if you have to cancel or cut short your trip due to covered reasons like illness, natural disasters, or other unforeseen events.

- Baggage Loss/Theft: Provides coverage for lost, stolen, or damaged baggage and personal belongings during the trip.

- Travel Delay: Offers reimbursement for additional expenses incurred due to delayed flights or missed connections.

- Emergency Assistance: Provides 24/7 support for travel-related emergencies, including medical referrals, legal assistance, and translation services.

Factors to Consider When Choosing Travel Insurance

When selecting a travel insurance plan, there are several key factors that travelers should take into consideration to ensure they have the coverage they need. Understanding the differences between single-trip and annual travel insurance policies, as well as the coverage for medical emergencies, trip cancellations, and lost baggage, can help travelers make an informed decision.

Types of Travel Insurance Policies

- Single-Trip Insurance: Provides coverage for a specific trip and is ideal for individuals who travel occasionally.

- Annual Insurance: Offers coverage for multiple trips within a year, making it cost-effective for frequent travelers.

Coverage Comparison

- Medical Emergencies: Look for coverage that includes medical expenses, emergency evacuation, and repatriation.

- Trip Cancellations: Check if the policy covers cancellations due to unforeseen circumstances such as illness, natural disasters, or airline strikes.

- Lost Baggage: Ensure the insurance provides reimbursement for lost or delayed baggage, including essential items.

How to Purchase Travel Insurance

.png?w=700)

When it comes to purchasing travel insurance, it is essential to understand the process and ensure you are adequately covered for your trip. Here is a step-by-step guide on how travelers can purchase travel insurance:

Finding a Reputable Travel Insurance Provider

- Start by researching reputable travel insurance providers. Look for companies with good reviews and a track record of providing excellent customer service.

- Check if the travel insurance provider offers the coverage you need for your trip, such as medical expenses, trip cancellation, or lost luggage.

- Compare quotes from different providers to find the best coverage at a competitive price.

- Consider purchasing travel insurance through a travel agent or booking platform, as they may have partnerships with trusted insurance companies.

Filing a Claim with a Travel Insurance Company

- Read and understand your travel insurance policy to know what is covered and the claims process.

- In case of an emergency or covered event during your trip, contact the travel insurance company as soon as possible to initiate the claims process.

- Provide all necessary documentation, such as medical reports, police reports, or receipts, to support your claim.

- Follow the instructions provided by the travel insurance company to ensure a smooth and efficient claims process.

Tips for Maximizing Travel Insurance Benefits

Travel insurance can provide peace of mind and financial protection during your trip, but to maximize its benefits, here are some tips to keep in mind:

Understand Your Policy Coverage

Before you travel, take the time to carefully read and understand your travel insurance policy. Make note of what is covered, including medical expenses, trip cancellations, and lost luggage. Understanding your coverage will help you make informed decisions while traveling.

Keep Documentation

In case you need to make a claim, it is essential to keep all documentation related to your trip and any incidents that may occur. This includes receipts, medical records, police reports, and any communication with airlines or tour operators.

Having proper documentation will facilitate the claims process.

Contact Your Insurer Immediately

If an incident occurs during your trip that may lead to a claim, contact your insurance provider as soon as possible. They can guide you on the next steps to take and ensure that you meet all requirements for making a claim.

Delaying in reporting an incident can lead to complications in the claims process.

Follow Procedures and Deadlines

Each insurance policy has specific procedures and deadlines for filing claims. Make sure to follow these guidelines closely to avoid any delays or denials in your claim. Be aware of any time limits for reporting incidents or submitting documentation.

Review Exclusions and Limitations

Understand the exclusions and limitations of your travel insurance policy. Certain activities, pre-existing conditions, or high-risk destinations may not be covered by your policy. Knowing these exclusions will help you plan accordingly and avoid any surprises during your trip.

Keep Emergency Contact Information Handy

Before you travel, make sure to have your insurance provider's emergency contact information readily available. In case of an emergency, you can quickly reach out to them for assistance and guidance on how to proceed.

Seek Assistance from Your Insurer

If you encounter any issues or have questions during your trip, do not hesitate to contact your insurance provider for help. They can provide valuable assistance, whether it's finding a local medical provider or arranging for emergency transportation.

Last Word

In conclusion, go ready travel insurance emerges as a crucial ally for travelers seeking peace of mind and protection during their journeys. By understanding the nuances of travel insurance coverage and maximizing its benefits, travelers can navigate the unpredictable nature of travel with confidence and security.

General Inquiries

What does travel insurance typically cover?

Travel insurance usually covers medical emergencies, trip cancellations, lost baggage, and other unforeseen circumstances depending on the policy.

Is it better to choose single-trip or annual travel insurance?

The choice between single-trip and annual travel insurance depends on how frequently you travel. Single-trip is ideal for occasional travelers, while annual insurance is more cost-effective for frequent travelers.

Where can travelers find reputable travel insurance providers?

Reputable travel insurance providers can be found through online research, travel agencies, or recommendations from experienced travelers.

What are some common mistakes travelers make with travel insurance claims?

Common mistakes include not reading the policy details thoroughly, delaying claim submissions, and not providing sufficient documentation to support the claim.

How can travelers maximize the benefits of their travel insurance?

Travelers can maximize benefits by understanding their policy coverage, keeping all necessary documents handy during travel, and seeking assistance from the insurance provider when needed.

![Best Seniors Travel Insurance Over 65 Quotes [Compare Rates]](https://management.vpn.co.id/wp-content/uploads/2025/10/International-Travel-Insurance-For-Seniors-120x86.png)