Embark on a journey through the world of travel insurance excluding pre-existing conditions. Discover why this type of coverage is vital and how it can benefit you as a traveler.

Delve deeper into the nuances of different insurance plans and learn how to navigate the complexities of pre-existing conditions in the realm of travel insurance.

Overview of Travel Insurance Excluding Pre-Existing Conditions

Travel insurance is a type of insurance that provides coverage for unexpected events that may occur during a trip, such as trip cancellations, medical emergencies, lost luggage, or other travel-related incidents. It is essential for travelers to protect themselves from potential financial losses or hardships while away from home.Pre-existing conditions refer to any medical conditions that existed before the effective date of the travel insurance policy.

These conditions are typically excluded from coverage unless specifically included in the policy or a waiver is obtained.Having coverage that excludes pre-existing conditions is significant because it ensures that the traveler is protected for unforeseen events that are not related to their existing medical conditions.

This allows travelers to have peace of mind knowing that they are covered for unexpected emergencies or incidents that may occur during their trip.

Types of Travel Insurance Plans

Travel insurance plans come in various types to suit different needs and preferences. When it comes to coverage for pre-existing conditions, there are plans that include them and those that exclude them. Let's take a closer look at the different types of travel insurance plans available and how they compare:

Plans with Pre-Existing Conditions Coverage

- Comprehensive Travel Insurance: These plans typically offer coverage for trip cancellations, medical emergencies, baggage loss, and more. They may also include coverage for pre-existing conditions, but with certain limitations and conditions.

- Specialized Medical Plans: Some insurance companies offer specialized medical plans that focus specifically on covering pre-existing conditions while traveling. These plans are designed for individuals with existing health concerns seeking comprehensive medical coverage.

Plans Excluding Pre-Existing Conditions

- Basic Travel Insurance: These plans usually provide coverage for common travel risks such as trip cancellations, delays, and lost baggage. However, they typically do not cover pre-existing conditions.

- Last-Minute Travel Insurance: These plans are designed for spontaneous travelers who book trips on short notice. While they offer quick coverage, they often exclude pre-existing conditions.

Examples of Insurance Companies Offering Plans Excluding Pre-Existing Conditions

- XYZ Insurance Company: XYZ Insurance Company offers travel insurance plans that exclude coverage for pre-existing conditions. Their plans focus on providing basic coverage for common travel risks.

- ABC Travel Insurance: ABC Travel Insurance also provides plans that do not cover pre-existing conditions. These plans are ideal for travelers looking for affordable and straightforward coverage.

Coverage Details of Travel Insurance Excluding Pre-Existing Conditions

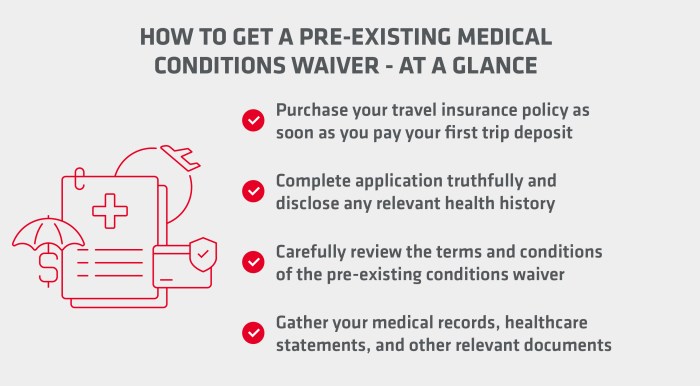

When it comes to travel insurance that excludes pre-existing conditions, it's essential to understand what is typically covered, common exclusions, and the process of filing a claim.

Covered Benefits

- Emergency medical expenses: Coverage for sudden illnesses or injuries that occur during your trip, such as hospital stays, surgeries, and prescription medications.

- Trip cancellation or interruption: Reimbursement for non-refundable trip expenses if you have to cancel or cut short your trip due to covered reasons like illness or natural disasters.

- Baggage loss or delay: Compensation for lost, stolen, or delayed baggage during your trip.

- Travel delay: Reimbursement for additional expenses incurred due to flight delays or cancellations.

Common Exclusions

- Pre-existing conditions: Any medical condition that existed before the start of the insurance policy will not be covered.

- High-risk activities: Engaging in activities like skydiving or mountaineering may not be covered unless specified in the policy.

- Alcohol or drug-related incidents: Injuries or accidents resulting from alcohol or drug use are typically excluded from coverage.

- War or terrorism: Damages or losses caused by war, terrorism, or civil unrest are usually not covered.

Claim Process

- Notify the insurance provider: Contact your insurance company as soon as possible in case of an emergency or covered event.

- Submit documentation: Provide all necessary documents, such as medical records, police reports, and receipts, to support your claim.

- Follow instructions: Follow the instructions given by the insurance company for processing your claim efficiently.

- Wait for approval: The insurance company will review your claim and determine if it meets the policy's coverage criteria.

Benefits of Opting for Travel Insurance Excluding Pre-Existing Conditions

When choosing a travel insurance policy that excludes pre-existing conditions, travelers can enjoy several advantages that can make their trip more secure and stress-free. By understanding these benefits, individuals can make a more informed decision when selecting the right insurance plan for their travels.

No Worries About Pre-Existing Conditions

One of the key benefits of opting for travel insurance that excludes pre-existing conditions is that travelers do not have to worry about their existing health issues affecting their coverage. This means that any medical emergencies or treatment related to pre-existing conditions will not be excluded from the policy, providing peace of mind during the trip.

Cost Savings and Comprehensive Coverage

Travelers can save money and benefit from more comprehensive coverage by choosing a policy that excludes pre-existing conditions. Since these conditions are not covered, insurance companies may offer lower premiums for such policies, making it a cost-effective option for travelers.

Additionally, without the restrictions of pre-existing conditions, travelers can enjoy a broader range of coverage for various unforeseen events during their trip.

Real-Life Scenarios

For example, consider a traveler who has a pre-existing heart condition and opts for travel insurance that excludes pre-existing conditions. During the trip, the traveler experiences a medical emergency related to their heart condition. Since the policy does not exclude pre-existing conditions, the traveler is able to receive coverage for the emergency medical expenses, providing financial protection and ensuring they receive the necessary treatment without additional stress.

Peace of Mind and Flexibility

By choosing travel insurance that excludes pre-existing conditions, travelers can have peace of mind knowing that they are covered for unexpected events without the limitations of pre-existing conditions. This type of policy offers flexibility and comprehensive protection, allowing travelers to focus on enjoying their trip without worrying about potential medical expenses or disruptions.Overall, opting for travel insurance that excludes pre-existing conditions can offer travelers a range of benefits, including cost savings, comprehensive coverage, peace of mind, and flexibility during their travels.

Outcome Summary

As we wrap up our discussion on travel insurance excluding pre-existing conditions, remember that having the right coverage can make all the difference during your adventures. Stay informed and travel with peace of mind.

FAQ

What exactly is considered a pre-existing condition in travel insurance?

A pre-existing condition is any medical condition that existed before you purchased your travel insurance policy, such as diabetes or high blood pressure.

Are all insurance companies offering plans that exclude pre-existing conditions?

No, not all insurance companies provide plans that exclude pre-existing conditions. It's essential to research and compare different companies to find the right coverage for your needs.

How can travelers benefit from choosing a policy that excludes pre-existing conditions?

By opting for a policy that excludes pre-existing conditions, travelers can avoid complications and ensure smoother claims processing in case of any medical emergencies during their trip.

![Best Seniors Travel Insurance Over 65 Quotes [Compare Rates]](https://management.vpn.co.id/wp-content/uploads/2025/10/International-Travel-Insurance-For-Seniors-120x86.png)